Today’s Australian Prudential Regulation Authority (APRA) data shows private health insurance membership continues to increase as health funds recorded a tenth consecutive quarter of membership growth.

People with cover for hospital treatment grew by 52,002 in the December 2023 quarter, while those with extras cover for services such as dental, optical and physio increased by 52,355.

In the 2022 calendar year, the number of people with cover hospital treatment increased by 2.2 per cent or 250,311 people, bringing the total number of Australians covered to 11,815,119 people.

Additionally, there are now 14,409,934 people with cover for extras. This means that well over half the Australian population are members of a health insurance fund.

Members Health Fund Alliance CEO, Matthew Koce, described the increase as a further demonstration of the enormous value Australian’s attach to fast, dependable high-quality healthcare.

“The sustained growth in private health insurance membership highlights the strong demand for choice and control in healthcare amongst an increasing number of Australians.”

“Private health insurance plays a crucial role in supporting Australians by providing timely access to high quality healthcare services, while also easing the pressure on our public system for those who need it most,” said Mr Koce.

“Millennials, by far the largest generation in Australia, are entering the age at which they want to start a family, and this will also be contributing to the sustained growth in policyholder numbers that we are experiencing.”

“Members Health funds cover more than 5 million Australians with the group experiencing prolonged growth that has outpaced the rest of industry average.”

“We put this growth down to people wanting to be part of our not-for-profit ethos and our desire to give back more in benefits, customer services and connection to communities”, Mr Koce said.

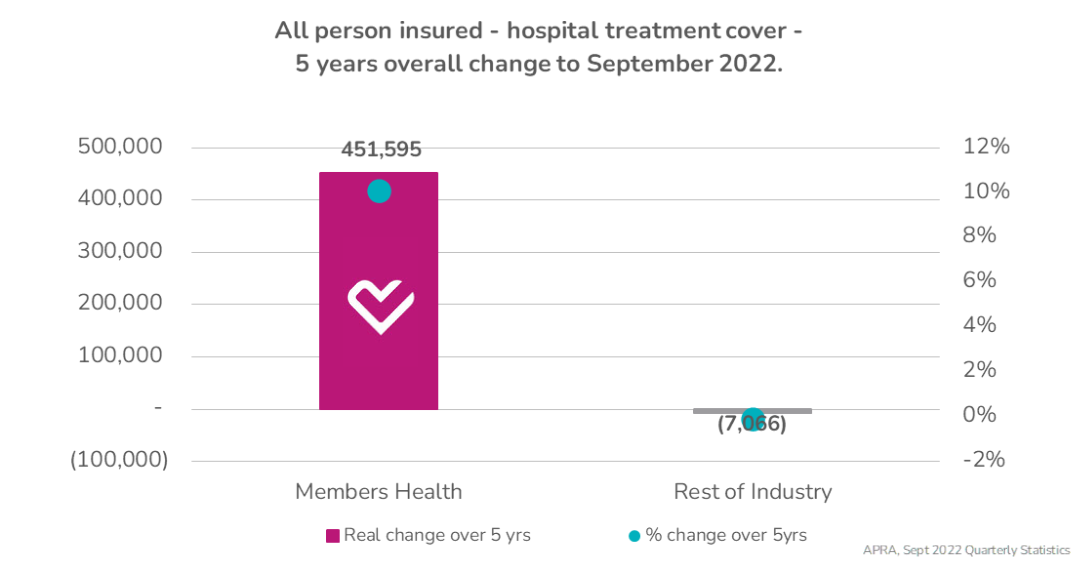

“Over the past five years, Members Health experienced amazing growth. The Hospital cover numbers from September 2022 showed that we increased by 10.09 per cent or 451,595 persons. In contrast, the rest of the industry has shrunk by -0.10 per cent or -7,066 persons over the same period.”

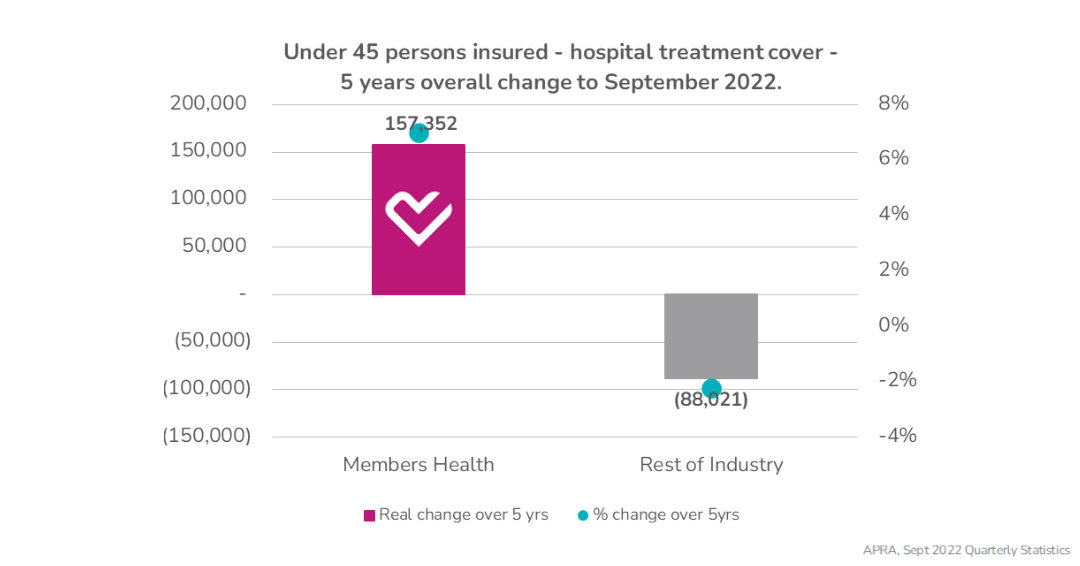

Among people aged under 45, the group of not-for-profit and member owned funds have grown hospital cover by 6.99% or 157,352 persons covered. The rest of the industry contracted by -2.23% or -88,021 persons.

“The statistics suggest that it is a tale of two cities, especially with younger Australians flocking to the Members Health brand.”

“When people join a Members Health fund, they get access to high quality healthcare, support for their wellbeing, and the peace of mind that comes with knowing their premiums go towards caring for their health, not the hip pockets of shareholders and overseas investors.” Mr Koce said.

Members Health is the peak industry body for an alliance of 25 health funds that are not-for-profit or part of a member-owned group, regional or community based. They all share the common ethic of putting their members’ health before profit. Our funds represent the interests of more than 5 million Australians.

Media Contact

Matt.Harris@membershealth.com.au

0479 135 464