Swelling public hospital waiting lists across the country are giving rise to risky buy-now, pay-later schemes for procedures in Australia’s private health care system.

Matthew Koce, CEO of Members Health, the peak body for 26 not-for-profit health funds, said the scheme was the latest example of the insecurity that many Australians face when they do not take out health cover and instead rely solely on the public system.

“Buy now, pay later (BNPL) threatens to leave users under a mountain of debt, rather than with the ongoing health security that not-for-profit health funds provide,” he said.

“Uninsured Australians are frequently languishing on year-long public wait lists, and the emergence of BNPL operators shows how desperate some people have become.

“This is a very troubling development triggered by the global pandemic; the public system has fallen so far behind that people are now being encouraged to take on thousands of dollars of debt just to take care of their health care needs.”

Mr Koce said consumer concerns about the BNPL industry were warranted.

“BNPL providers are not subject to the National Consumer Credit Protection Act, so people don’t have the same kind of protections as they would with other financial products. BNPL services aren’t governed by responsible lending requirements, so there’s a real risk that people could end up with a loan they simply can’t afford,” Mr Koce said.

“Taking out unsecured credit to pay for healthcare has never been in the Australian psyche –and during a global pandemic is certainly not the time to start.”

Mr Koce said the growth of waiting lists and times, and emergence of so called ‘alternatives’ such as BNPL, would spur participation in private health insurance.

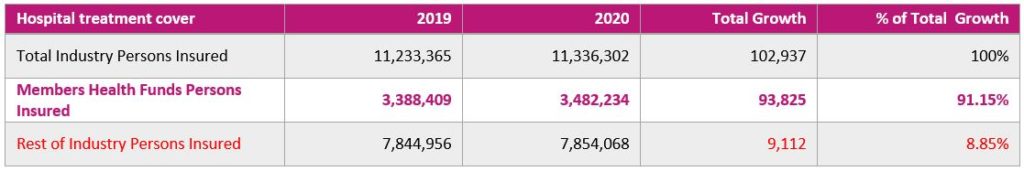

“The latest Australian Prudential Regulation Authority data shows hospital treatment fund membership across the sector grew in 2020,” he said. “The really interesting aspect is that almost all of the growth was spread across Members Health funds.

“The sector attracted 102,100 new members – Members Health funds attracted 91%, or more than 93,000 of them, while the rest of the industry basically treading water.

“Faced with frightening prospect of either a year-long wait for surgery in the public system or thousands of dollars in debt to an unregulated BNPL provider, it’s no wonder people are flocking Members Health funds – funds that are run for people, not for profit,” Mr Koce said.

Members Health is the peak industry body for an alliance of 26 health funds that are not-for-profit or part of a member-owned group, regional or community based. They all share the common ethic of putting their members’ health before profit. Our funds represent the interests of more than 3.9 million Australians.

Media Contact:

Eddie.Morton@membershealth.com.au

0499 700 295