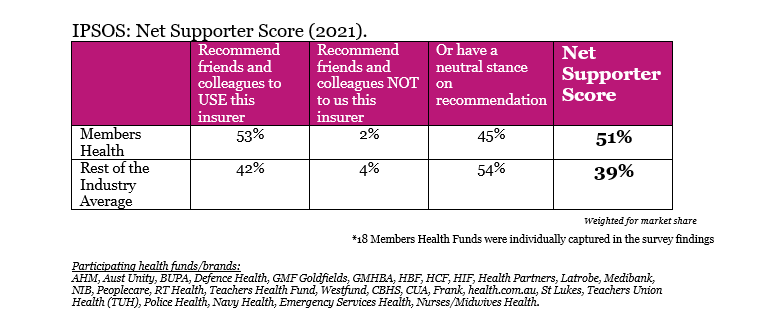

New independent research by IPSOS signals much higher levels of consumer confidence in the alliance of not for profit and member owned health insurance funds.

According to IPSOS, more people would recommend a Members Health fund than other leading brands.

“People belonging to a Members Health Fund are much more likely to recommend one of our funds to their friends or colleagues. With customer satisfaction consistently at 94% or higher we are not surprised by these findings”, said Matthew Koce, CEO of Members Health.

“The IPSOS findings reflect the commitment that our community of funds have in providing members with health cover that is responsive, affordable and high quality.”

“Members Health funds provide cover to more than 5 million Australians, a number that is growing much faster than the industry average.”

Mr Koce said the survey results demonstrate the value Australians attach to the people before profit focus of the Members Health funds.

“A 51 per cent net supporter score is clear indication that Members Health funds are continuing to serve the health needs and expectations of their policyholders.”

In contrast, the rest of the industry averaged a net supporter score of just 39%.

“Compared to other funds, Members Health funds are entirely consumer centric and the health cover they offer is built on integrity.”

“Members Health funds are not-for-profit and member owned that only exist to benefit customers.”

“While the for-profit funds need to generate a financial return for shareholders and overseas investors, Members Health funds do not.”

“The fact that there is a diverse range of health funds operating solely in the interests of their members is delivering tangible benefits to Australian families,” Mr Koce said.

“We’re not beholden to shareholders or overseas investors. We return more benefits back to our members. According to APRA, as a group we return 86.9 cents in the dollar back, ahead of the rest of the industry which averages returns of just 85 cents.”

This means that on average, the people who belong to Members Health funds can expect to get more back in benefits.

According to Canstar, one of Australia’s biggest financial comparison sites, the average annual cost of health insurance for a family aged 36 – 59 years, is $5,076.

A family belonging to one of the Members Health funds could expect to receive a higher proportion of their premiums as benefits, an average benefit return of 86.9%* or $4,411.04, while a family choosing another fund would get an average return of 85% or $4,314.60.

This means an average of $$96.44 more to the family if they choose a Members Health fund.

On the same basis, a single person would get $47.92 more, while a couple would get $92.61 if they chose a Members Health fund.

“It’s no wonder they’re proving so popular and together are growing much faster than the industry average and achieve customer retention rates far surpassing the others.”

“Not all health funds are the same. Whether it be quality of health cover, advice to members, fast payment of claims or value for money.”

“The independent research makes it clear that people are more likely to recommend a Members Health fund and that is a reflection our funds perform at extremely high standards,” Mr Koce said.

Members Health is the peak industry body for an alliance of 26 health funds that are not-for-profit or part of a member-owned group, regional or community based. They all share the common ethic of putting their members’ health before profit. Our funds represent the interests of more than 5 million Australians.

Media Contact

Matt.Harris@membershealth.com.au

0479 135 464