Private health insurance participation across Australia has hit a new all-time high.

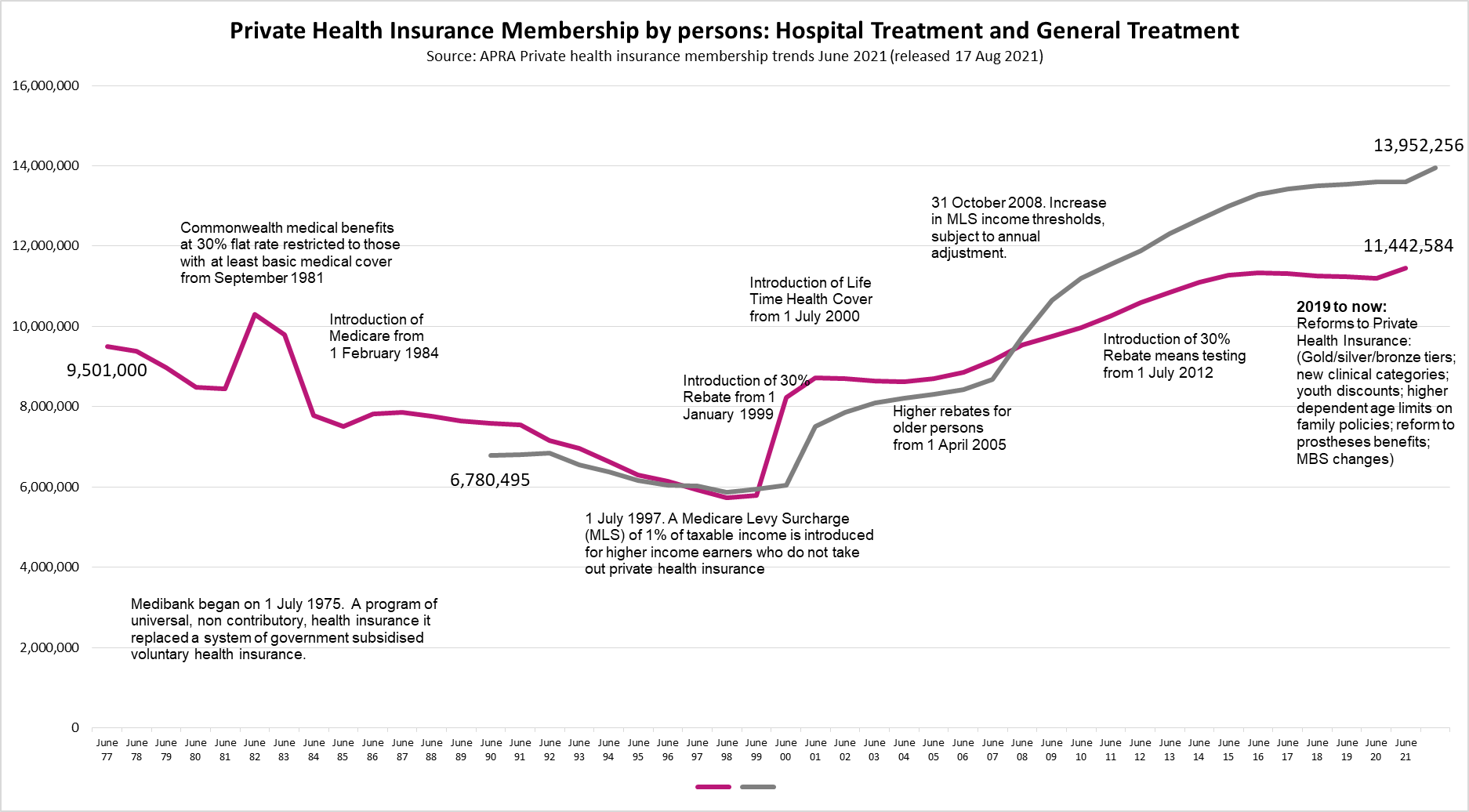

APRA figures show the number of people with hospital treatment cover increased 46,403 from the March to June quarters. More than 11.4 million Australians, or 44.5% of the population, now have hospital treatment cover.

The number of people with general treatment cover for services such as dental, optical and physio increased 65,380, bringing the total number covered to almost 14 million people or 54.3% of the population.

Matthew Koce, CEO of Members Health, the peak body for 26 health funds that are not for profit or member owned, said the sustained growth over the past four quarters was a clear and unequivocal demonstration of confidence in private health system.

“The COVID-19 pandemic has helped contribute to a growing appreciation of the enormous value and peace of mind that comes with private health cover,” Mr Koce said.

“Nothing could be more important than your health and that of your loved ones. Private health insurance assures the fastest available access to high quality care with doctor of choice. Importantly, it also helps to free up beds in overstretched public hospitals.

“Australia’s ageing population, growing burden of chronic disease and the COVID-19 pandemic have created a perfect storm for what was an already ailing public health system. Long public hospital waits for emergency care and elective surgery have become much more commonplace, highlighting the importance of the private health care system.

“As more people switch to private health care, it will help free up public hospital beds, reducing the enormous pressure they are expected to experience for many years to come. Waits for some procedures in the public system can extend well into the years.”

Mr Koce said the private health insurance industry’s increased profitability for the June quarter was due to a steep decline in profitability during previous quarters, combined with the commencement of a gradual unwinding of the deferred claims liability (DCL) realised during the height of the COVID-19 pandemic last year.

“It is pleasing that since April 2021 APRA has allowed health insurers to gradually return unspent monies in the DCL back to their balance sheets so they can be returned to policyholders,” Mr Koce said.

“Members Health funds are not for profit and member owned and are committed to returning the unspent DCL back to policyholders through lower premiums.”

“Health insurers were quick to introduce premium deferrals, waivers, hardship relief and telehealth at the outset of the COVID-19 pandemic. They remain committed to working with APRA and stand ready to continue supporting their policyholders throughout the ongoing pandemic.”

Members Health is the peak industry body for an alliance of 26 health funds that are not-for-profit or part of a member-owned group, regional or community based. They all share the common ethic of putting their members’ health before profit. Our funds represent the interests of more than 3.7 million Australians.

Eddie.Morton@membershealth.com.au

0499 700 295