The looming crisis in Australia’s public health care system is driving more Australians to take out private cover to avoid massive waiting lists for important surgeries.

While States across the country struggle to manage demand on public hospitals, figures from the Australian Prudential Regulation Authority (APRA) consistently show people of all ages are turning to the country’s private system for peace of mind.

Matthew Koce, CEO of Member Health, the peak body for 26 of the country’s not-for-profit and member owned health funds, said there’s never been a more pressing time for Australians to get health cover.

“Public hospitals across the country have been impacted by COVID-19 as they try to accommodate the very real risk of a full-blown pandemic crisis,” Mr Koce said.

“Public patients needing elective surgery have had to be moved to the side, with waits now blowing out into years, not months.”

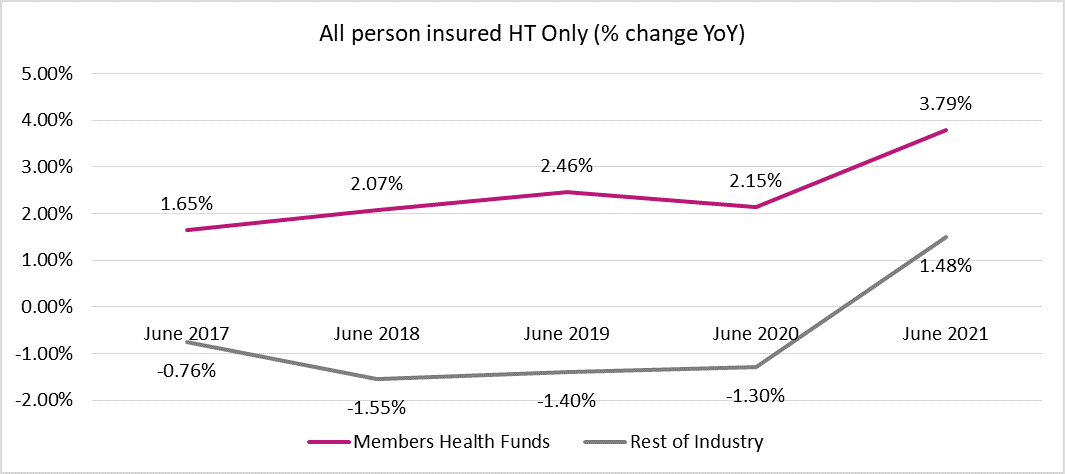

Members Health’s exclusive analysis of APRA private health insurance industry data, current to the latest quarter (June 30, 2021), shows that the number of people joining Members Health funds has surged.

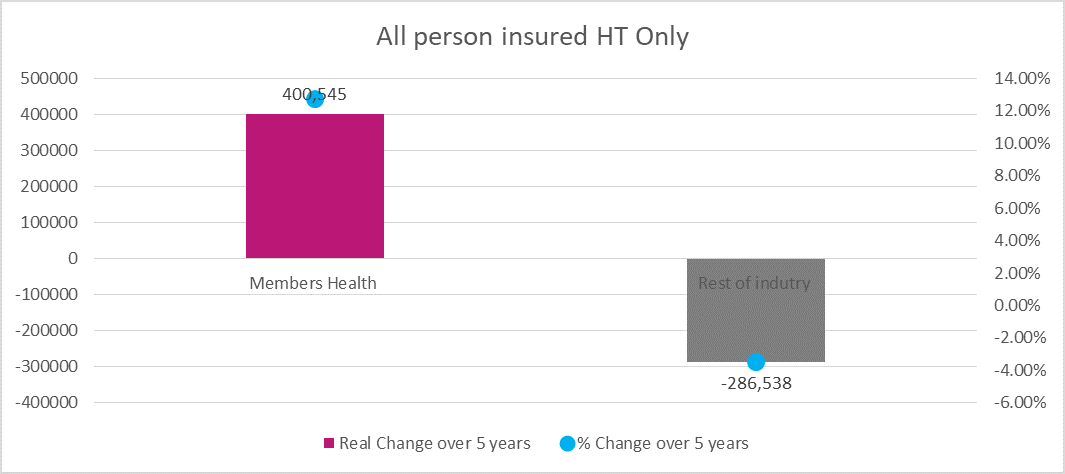

Over the past year, Members Health funds have grown their number of people covered on hospital policies by about 3.8 per cent – more than twice the pace of the rest of the industry. Their market share has lifted from around 28 per cent to an all-time high of more than 31 per cent. As a group the Members Health funds are now larger than Medibank or Bupa.

The past 12 months tops a stellar five-year period for the Members Health funds, growing consistently between two and three times’ the rate of the rest of the industry.

“Since 2016, our funds have attracted more than 400,000 new people to their hospital treatment policies – a remarkable increase of 12.7 per cent,” Mr Koce said.

“People of all ages are voting with their feet when it comes to health cover. In a year that has forced many Australians to reflect upon their future wellbeing, it is especially encouraging to see so many young and healthy people take out cover with a not-for-profit or member owned fund they can trust.”

According to the latest figures, Members Health funds have seen higher growth rates across key age groups including under 25s and the important family raising years of 30-39s.

“The future of Australia’s community rated private health care system relies on young people taking out cover and it is reassuring to see all of industry growth for those aged 45 and under exceed 124,000 over the last 12 months,” Mr Koce said.

Australia’s mixed public and private health system is uniquely placed to give us the best of both worlds. People with private health cover not only receive peace of mind around access to the fastest and most efficient available care, with doctor of choice, they also help take pressure off public hospitals by freeing up beds for those most in need.

Members Health is the peak body for an alliance of 26 health funds that are not-for-profit or part of a member-owned group, regional or community based. They all share the common ethic of putting their members’ health before profit. Our funds represent the interests of more than 3.9 million Australians.

Download the full Data Pack here

Explanatory Note: The data in the attached release compares Members Health group to the Rest of Industry. Members Health group represents the collective persons insured, and average collective growth rate of all 26 member funds of Members Health Fund Alliance. Rest of Industry represents the collective persons insured, and average collective growth rate of all funds not in the Members Health Fund Alliance.

Media enquiries: Eddie Morton | 0499 700 295 | Eddie.Morton@membershealth.com.au