Younger Australians are flocking to not-for-profit and member-owned health funds in their thousands.

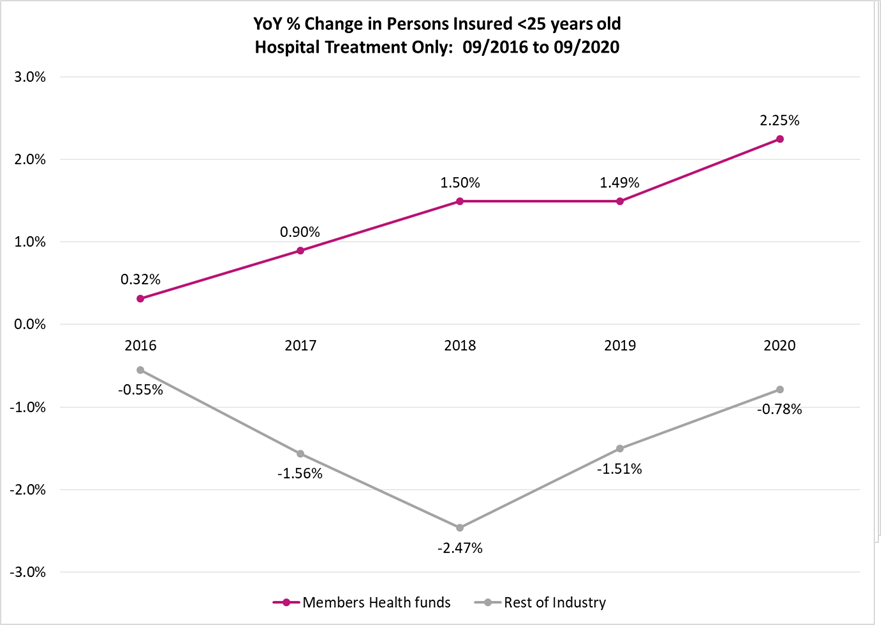

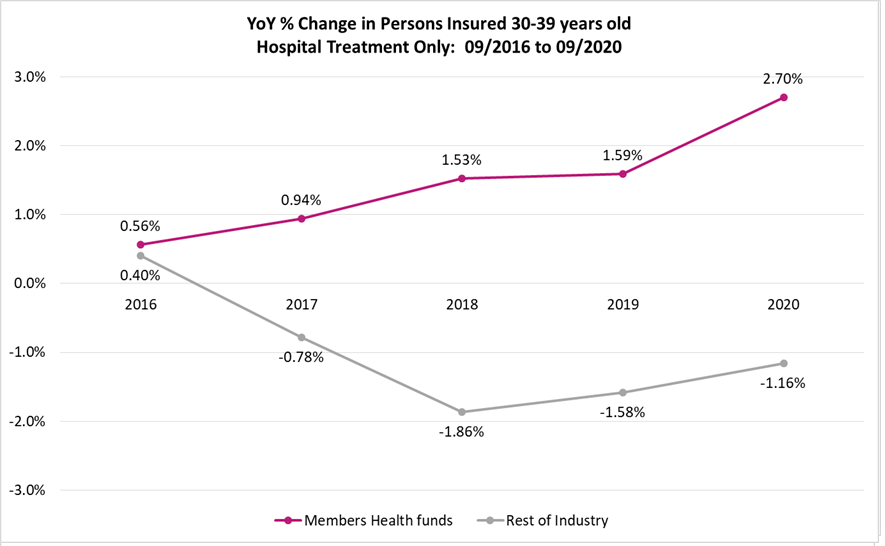

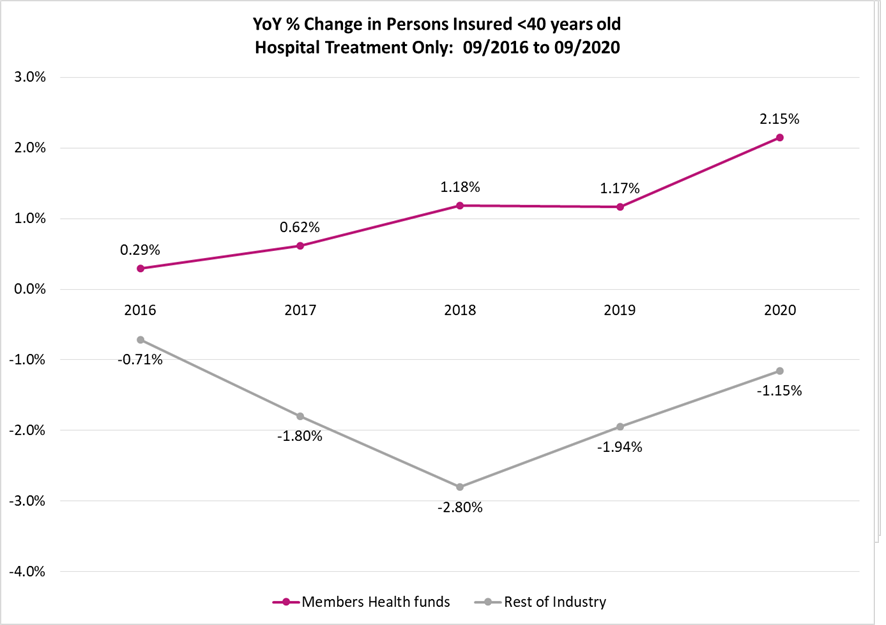

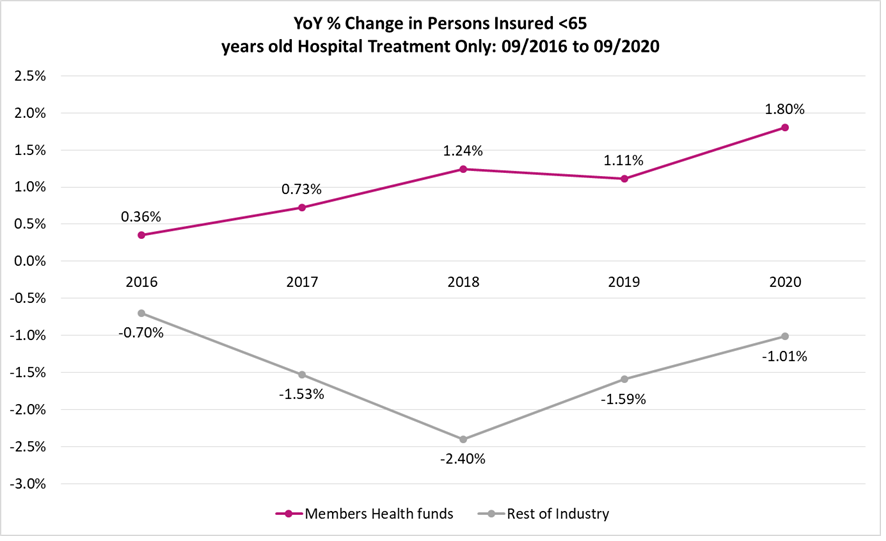

According to Government data, as a group the 26 Members Health funds grew with policyholders aged under 40 by more than 2.15 per cent for the year to September 2020. In contrast, the rest of the industry shrunk by 1.15 per cent.

“It is very much a tale of two cities when it comes to the private health insurance, with younger Australians increasingly attracted to the customer-first values of the Members Health funds.” Members Health CEO Matthew Koce said.

“It is no accident that over the five years to September 2020, a staggering 78,667 people under 40 chose to join Members Health funds.”

“Media reports claiming that younger people are shunning private health insurance fails to acknowledge the very real difference in performance between Members Health funds and the rest of the industry,” Mr Koce said.

“Members Health has consistently recorded impressive growth in younger age groups, even throughout the COVID-19 pandemic, because of their shared customer-first values.”

Since COVID-19 reached Australian shores, Members Health funds have committed an unprecedented +$250 million towards customer support measures. Support measures include generous premium deferrals, waivers, discounts or suspensions, expanded benefits coverage for COVID-19 related treatments and increased telehealth services.

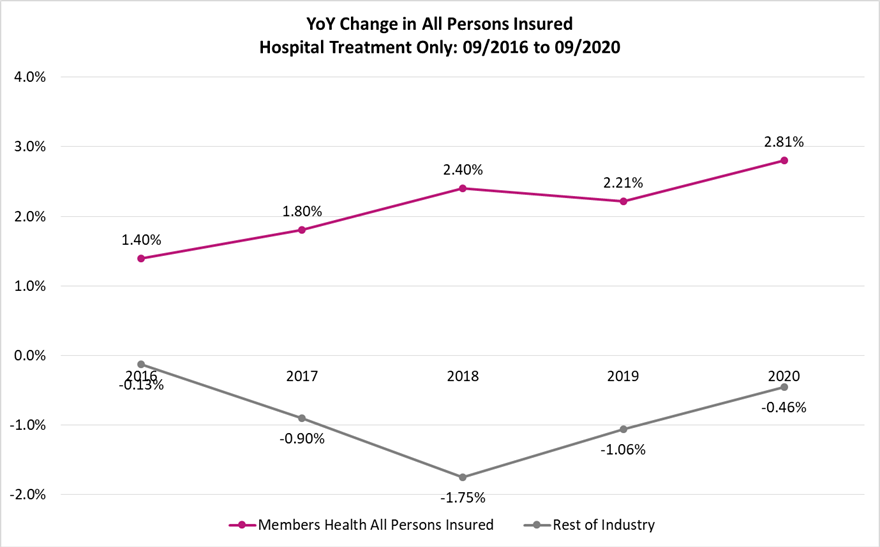

Members Health funds are run for people, not for profits and that makes all the difference. They do not have to serve the interests of shareholders or overseas investors and are able to return more of the premium dollar back to members in health benefits. As at September 30, Members Health funds averaged annual membership growth in hospital treatment policies of 2.8 per cent, whereas the rest of the industry shrunk by 0.46 per cent.

Annual surveys of Members Health funds versus other major Australian brands consistently show exceptional trust scores and very high customer satisfaction among their memberships. So it is no wonder they are growing so strongly.

“Australians, especially younger Australians, are discerning and want health cover they can trust, get value from, and be confident in to support their active lifestyles,” Mr Koce said.

As the holiday season approaches and we start to get more active after pandemic lockdowns, now is an especially important time for younger Australians to consider their health cover needs.

Quickly getting back on your feet and returning to an active lifestyle, doing the things you enjoy, is especially important when you are young. Post COVID-19, public hospital waits have blown out to well beyond a year for many surgeries, so health cover has never been more important.

“Camping or hiking in the outback can be fun but can also quickly turn into a monster of a bill if an air ambulance is required. But with health insurance you are covered. Your health fund will help get you to hospital as well as provide the fastest available access to high quality care, with your doctor of choice.”

Members Health is the peak industry body for an alliance of 26 health funds that are not-for-profit or part of a member-owned group, regional or community based. They all share the common ethic of putting their members’ health before profit. Our funds represent the interests of more than 3.7 million Australians.

.

.

Download the press release and data here

For interviews or questions, please contact:

Eddie Morton

Head of Policy and Communications | Members Health

Eddie.Morton@membershealth.com.au | 0499 700 295